Solana (SOL) appears ready to outpace Bitcoin (BTC), driven by a combination of bullish technical indicators and record-breaking activity on Solana-based decentralized exchanges (DEXs). With SOL/BTC breaking out of a prolonged consolidation phase, the bullish momentum is reinforced by robust fundamentals, making Solana a standout in the cryptocurrency market.

Bullish Price Breakout: A Shift in Momentum

SOL/BTC Triangle Consolidation Ends with a Bang

After eight months of stalemate between bulls and bears, the SOL/BTC trading pair has broken out of a triangular consolidation pattern. This technical breakout signals a potential sustained uptrend, with bullish sentiment dominating price action.

Momentum Indicators Confirm the Trend

The Moving Average Convergence/Divergence (MACD) histogram—a tool for identifying trend shifts—has crossed above zero, further validating the bullish momentum. This shift indicates that the market is ready for higher price levels, aligning technical signals with Solana’s strong on-chain performance.

Fundamentals Drive Solana’s Ascent

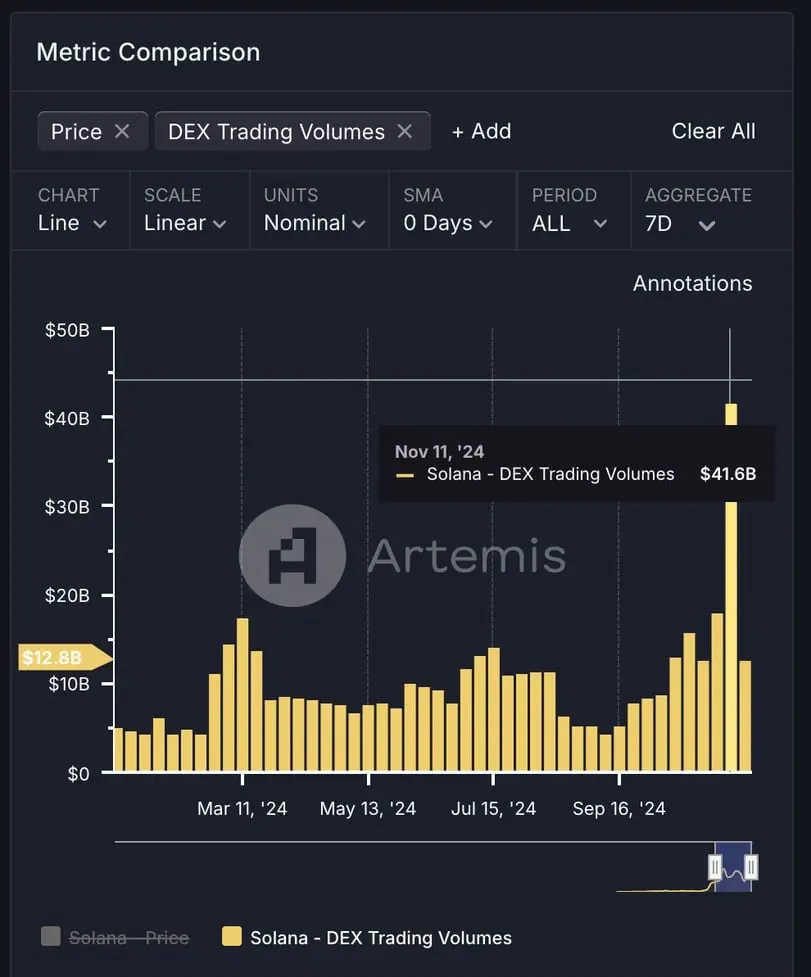

Record DEX Trading Volumes

Solana-based DEXs recorded an astounding $41.6 billion in trading volume during the week ending November 17, doubling the activity of the previous week and setting a new record. This figure surpasses the combined trading volume of Ethereum, Base, and Binance Smart Chain (BSC), which collectively managed $37.9 billion.

Solana Outpaces Rivals

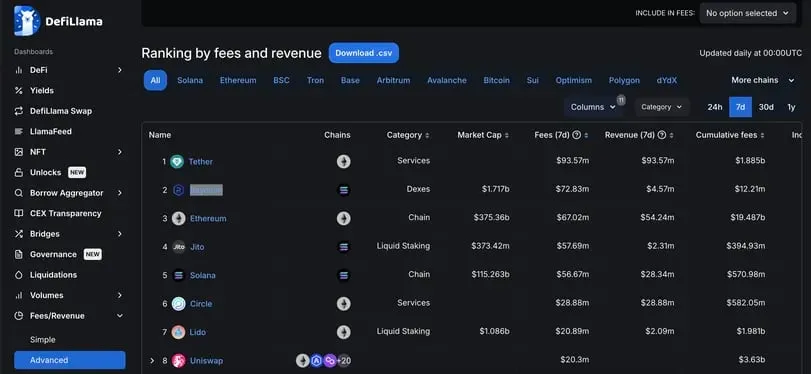

Not only is Solana leading in volume, but its ecosystem also remains highly cost-effective. For example, Raydium, a Solana-based DEX, generated $72.83 million in fees over seven days—8% more than Ethereum’s $67 million, despite Solana being known for its lower transaction costs.

Retail Adoption Boosts Solana’s Growth

Solana has become the go-to platform for retail investors trading memecoins and other tokens. This surge in user activity aligns perfectly with the bullish price breakout, further solidifying Solana’s position as a leading blockchain for decentralized trading.

Can Solana Surpass Ethereum?

The debate over whether Solana can dethrone Ethereum as the top smart contract blockchain continues. While Ethereum remains dominant in some metrics, Solana’s explosive growth and higher trading volumes highlight its ability to attract users and developers, challenging the status quo in the blockchain space.

Conclusion: A Bright Future for SOL

With technical indicators signaling a sustained uptrend and fundamentals backing the momentum, Solana is positioned for continued growth. Its ability to outperform both Bitcoin and Ethereum in certain key areas, including trading volume and fee generation, demonstrates its potential to reshape the cryptocurrency landscape.

As the market watches, Solana’s combination of innovation, scalability, and cost-efficiency may propel it further, making it a strong contender in the evolving blockchain ecosystem.

FAQ: Solana’s Surge in Trading Volume and the SOL/BTC Bullish Breakout

1. What is driving Solana’s recent surge in trading volume?

Solana has experienced a massive boost in trading activity, with Solana-based decentralized exchanges (DEXs) reaching a record $41.6 billion in trading volume for the week ending November 17. This surge is driven by increased retail investment, particularly in memecoins, and Solana’s cost-effective platform compared to Ethereum.

2. How does the SOL/BTC ratio indicate a bullish trend?

The SOL/BTC trading pair has recently broken out of a prolonged triangular consolidation, signaling a bullish trend. Technical indicators like the Moving Average Convergence/Divergence (MACD) have crossed above zero, suggesting renewed momentum for Solana. This indicates that the price is likely to continue rising, with bulls taking control of the market.

3. How does Solana compare to Ethereum and other blockchains in terms of DEX trading volume?

Solana’s DEXs have outpaced Ethereum, Base, and Binance Smart Chain (BSC) in trading volume, with Solana generating more than $41 billion in a week, surpassing the combined volume of Ethereum ($14.3 billion), Base, and BSC. This impressive performance highlights Solana’s increasing dominance in decentralized finance (DeFi).

4. How is Solana maintaining its competitive edge over Ethereum?

Solana continues to offer lower transaction fees, making it an attractive choice for users and developers. For example, Solana-based DEX Raydium generated $72.83 million in fees over seven days, outperforming Ethereum’s DEX fees of $67 million. Solana’s scalability and low-cost transactions are major factors in its growing market share.

5. Can Solana challenge Ethereum’s position as the top smart contract blockchain?

While there is ongoing debate about whether Solana can surpass Ethereum, the recent surge in trading volumes and Solana’s technological advancements suggest it is becoming a serious competitor. Solana’s ability to handle higher trading volumes with lower fees positions it as a strong challenger in the smart contract and DeFi space.

Solana’s strong performance and market positioning continue to make waves in the crypto industry, highlighting its potential for sustained growth and success in the coming months.