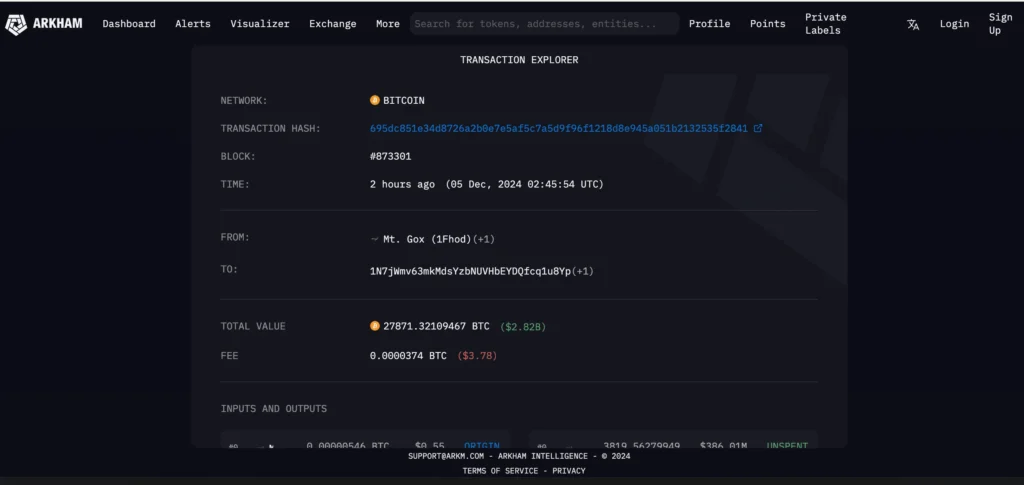

The cryptocurrency market witnessed a significant development as the defunct exchange Mt. Gox moved $2.8 billion worth of Bitcoin to an unknown wallet address. This move coincided with Bitcoin’s historic surge past $100,000, drawing attention from crypto enthusiasts and analysts alike.

Details of the Massive Bitcoin Transfer

A Staggering Shift of Funds

Mt. Gox, once the world’s largest Bitcoin exchange, transferred 27,871 BTC—valued at $2.8 billion—to an unidentified address. Despite this transaction, the exchange still retains 39,878 BTC, worth over $4 billion at current market prices.

Connection to Creditor Repayments

The transfer is believed to be tied to the ongoing creditor reimbursement process, a legacy of Mt. Gox’s collapse. Earlier this year, similar movements raised concerns of potential market pressure. The deadline for these repayments has recently been extended to October 31, 2025, offering more time for creditors to receive their dues.

Bitcoin’s Stability Amid High-Profile Transactions

Even with this significant outflow, Bitcoin has maintained impressive stability, trading above $103,000.

No Signs of Weakness

Historically, such large transfers have created short-term volatility. However, Bitcoin’s resilience amid this activity highlights its growing strength and maturity as an asset. Investor confidence remains unshaken, showcasing a market less prone to panic in response to major on-chain movements.

Mt. Gox’s Ongoing Influence

A Legacy That Persists

Years after its closure, Mt. Gox continues to cast a shadow over the crypto market. Each movement of its substantial Bitcoin reserves garners widespread attention, reflecting the enduring impact of its collapse on the industry.

Progress Toward Resolution

These transfers mark incremental progress in resolving the exchange’s troubled past. While delays in creditor repayments have persisted, such actions suggest forward momentum in addressing one of the most notorious episodes in cryptocurrency history.

Future Implications for Bitcoin

As Bitcoin consolidates above $100,000, all eyes are on how Mt. Gox will manage its remaining holdings and the ongoing repayment process. The market’s ability to absorb these developments with minimal disruption is a testament to Bitcoin’s evolution as a robust financial asset.

This milestone further solidifies Bitcoin’s status as a key player in global finance. The cryptocurrency’s resilience amid Mt. Gox-related activities indicates a strong foundation for continued growth and long-term adoption.