Ethereum’s native token, Ether (ETH), once celebrated as the “silver” to Bitcoin’s “gold,” has seen a significant drop in investor enthusiasm. This trend is evident in market data, as the probability of ETH revisiting its year-to-date high of $4,000 by the end of December stands at a mere 10%. Let’s explore the reasons behind this underperformance and what the future might hold.

ETH’s Underwhelming Performance Compared to Bitcoin

While Bitcoin (BTC) has surged an impressive 109% in 2023, ETH has lagged behind with only a 36% increase. Despite reaching $3,100 in market value, ETH remains far below its all-time high of $4,832 recorded in 2021. Meanwhile, BTC continues to break records, currently trading above $90,000.

Market Sentiment and Derivative Insights

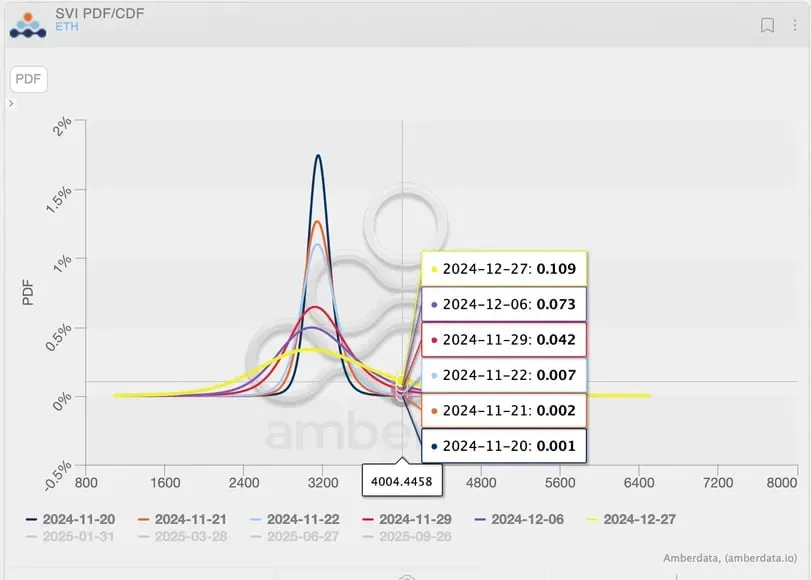

Options trading on Deribit, the leading crypto options exchange, paints a bleak picture for ETH. The Probability Density Function (PDF) and Cumulative Distribution Function (CDF) charts indicate limited optimism, showing just a 10% chance of ETH surpassing $4,000 by late December. This subdued outlook reflects broader market skepticism about Ethereum’s fundamentals.

Key Challenges Facing ETH

Weak Fundamentals

One of ETH’s primary issues lies in its diminished use as “sound money.” Ethereum’s transition to a deflationary supply model, driven by transaction fee burns, has reversed due to a shift in transaction volume from Ethereum’s Layer 1 (L1) to Layer 2 (L2) solutions. According to Greg Magadini, Director of Derivatives at Amberdata, this migration is a major factor dragging ETH prices down.

“Nearly all DeFi transactions are now executed on L2s instead of Ethereum’s main chain, which weakens ETH’s value proposition as a deflationary asset,” Magadini stated in a recent newsletter.

Long-Term Prospects: The Beam Chain Proposal

At Ethereum’s recent Devcon event, researcher Justin Drake proposed the Beam Chain, a significant upgrade aimed at reducing block times from 12 seconds to 4 seconds. This change could increase the volume of transactions processed on Ethereum’s main chain, potentially reversing the L2 migration trend. However, the Beam Chain is still in its early stages and could take years to implement—if it becomes a reality at all.

Could Bitcoin’s Momentum Boost ETH?

Despite Ethereum’s current struggles, a rapid rise in Bitcoin’s value could indirectly lift ETH prices. However, ETH is likely to continue underperforming relative to BTC, even if it manages to breach the $4,000 mark.

The Road Ahead

Ethereum faces significant headwinds from both internal and external factors. While ambitious proposals like Beam Chain may improve its fundamentals in the long term, ETH’s near-term outlook remains overshadowed by its reliance on external drivers, such as Bitcoin’s performance.

As the crypto market evolves, investors will be closely watching whether Ethereum can regain its footing or if it will remain a shadow of its former glory.

FAQ: Understanding Ethereum’s Ether and Its Current Market Challenges

1. Why is Ethereum’s Ether (ETH) underperforming in 2023?

ETH has only risen 36% this year, significantly trailing Bitcoin’s 109% surge. The underperformance stems from weak fundamentals, such as decreased transaction activity on Ethereum Layer 1 due to a shift toward Layer 2 solutions. Additionally, ETH’s deflationary model has reversed to an inflationary trend, dampening its appeal as “sound money.”

2. What are the chances of ETH surpassing $4,000 by the year-end?

According to options trading data from Deribit, the probability of ETH reaching $4,000 by December 27 is just 10%. This reflects subdued market sentiment and highlights the challenges ETH faces in reclaiming investor interest.

3. How is the migration to Layer 2 solutions impacting ETH’s value?

Layer 2 platforms now handle the majority of Ethereum-based DeFi transactions, reducing the demand for Ethereum Layer 1 activity. This shift has weakened ETH’s transaction fee burns, causing a supply increase that impacts its value and undermines its deflationary narrative.

4. What is the Beam Chain proposal, and how could it help Ethereum?

The Beam Chain is a proposed upgrade to reduce Ethereum block times from 12 seconds to 4 seconds. This would increase transaction throughput on the Ethereum main chain, potentially reversing the migration to Layer 2 solutions and strengthening ETH’s fundamentals. However, the Beam Chain remains in early development and could take years to materialize.

5. Can Bitcoin’s rally positively influence Ethereum’s performance?

Bitcoin’s ongoing momentum, with prices reaching record highs above $90,000, could indirectly boost ETH above $4,000. However, ETH is likely to continue underperforming compared to BTC due to weaker fundamentals and reduced market confidence.