Bitcoin has officially crossed the $100,000 threshold for the first time, marking a pivotal moment in its history. This surge reflects the cryptocurrency’s rising influence in the global financial markets, as its market capitalization inches closer to an impressive $2 trillion.

Factors Driving Bitcoin’s Remarkable Rally

1. Spot Bitcoin ETFs Revolutionize Access

The launch of spot Bitcoin exchange-traded funds (ETFs) in early 2024 was a turning point for institutional adoption. Financial giants like BlackRock and Fidelity spearheaded these ETFs, making it easier for investors to gain exposure to Bitcoin. In less than a year, these funds have managed to accumulate $30 billion in assets under management, significantly boosting demand and liquidity.

2. Favorable Political Environment

The election of a pro-crypto U.S. president in November reignited momentum in the market. This political shift alleviated regulatory uncertainties, encouraging a rally that saw Bitcoin climb from $73,500 in March to its new record-breaking highs.

The Role of Corporate Adoption

Corporations have played a critical role in Bitcoin’s meteoric rise.

- MicroStrategy’s Leadership: MicroStrategy has been a trailblazer in corporate Bitcoin investment, holding 386,700 tokens worth over $38 billion. Its strategy has inspired other companies to adopt Bitcoin as a treasury asset.

- Expanding Interest: Companies across industries, including tech giants, are considering integrating Bitcoin into their financial strategies, reflecting growing confidence in its stability and value.

Bitcoin’s Market Value in Perspective

At nearly $2 trillion, Bitcoin’s market capitalization now rivals some of the most valuable entities in the world:

- Tech Titans: Companies like Apple and Nvidia are valued at $3.5 trillion, while Microsoft’s market cap stands at $3 trillion.

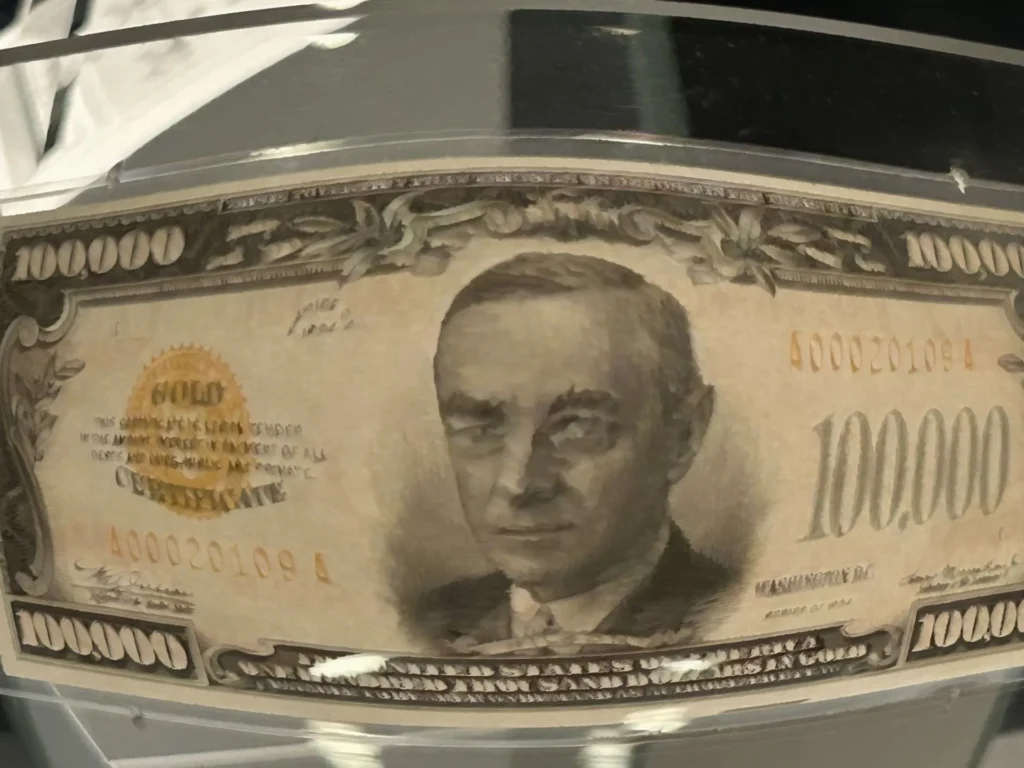

- Gold Comparison: Bitcoin’s valuation is steadily approaching the $17.7 trillion market cap of all gold, reinforcing its reputation as a modern alternative to the precious metal.

This milestone underscores Bitcoin’s transformation from a speculative asset to a cornerstone of the global financial system.

Looking Ahead

Bitcoin’s journey to $100,000 is a testament to its growing acceptance and utility. Institutional and corporate adoption, coupled with a favorable regulatory climate, positions Bitcoin for continued growth and innovation.

As the financial landscape evolves, Bitcoin is likely to play an even greater role in shaping the future of decentralized finance. Its resilience and adaptability have paved the way for new opportunities, signaling that this milestone is just the beginning of an exciting new chapter.